AG Exemption Valuation

Using Bees for Agricultural Property Tax Exemption in Texas

How Beekeeping Qualifies Your Land for Special Tax Valuation

In Texas, landowners can take advantage of agricultural property tax exemptions, also known as “ag valuation,” by engaging in qualified agricultural activities. Beekeeping is recognized as one of these activities, making it possible for landowners to receive significant property tax reductions if they maintain bees on their land according to state guidelines. The exemption is designed to support and encourage agricultural activities within the State of Texas. The program acknowledges the importance of agriculture within Texas and offers this tax relief to:

- Promote Agricultural: Encourage landowners to utilize their property for agricultural purposes.

- Encourage Environmental Stewardship: Texas understands that those who make their living from the land are the ones that take care of it as well.

- Ease Financial Burden: Help agricultural producers lower operating costs.

- Support Rural Communities: Contribute to the economic sustainability of rural areas and the agricultural sector.

What Is the Agricultural Property Tax Exemption?

The agricultural property tax exemption allows land used for agricultural production to be assessed at a lower value than it would be as residential or commercial property. This means that qualifying landowners pay lower property taxes, which can result in substantial savings each year; you may qualify to pay as little as 1% of your current property taxes.

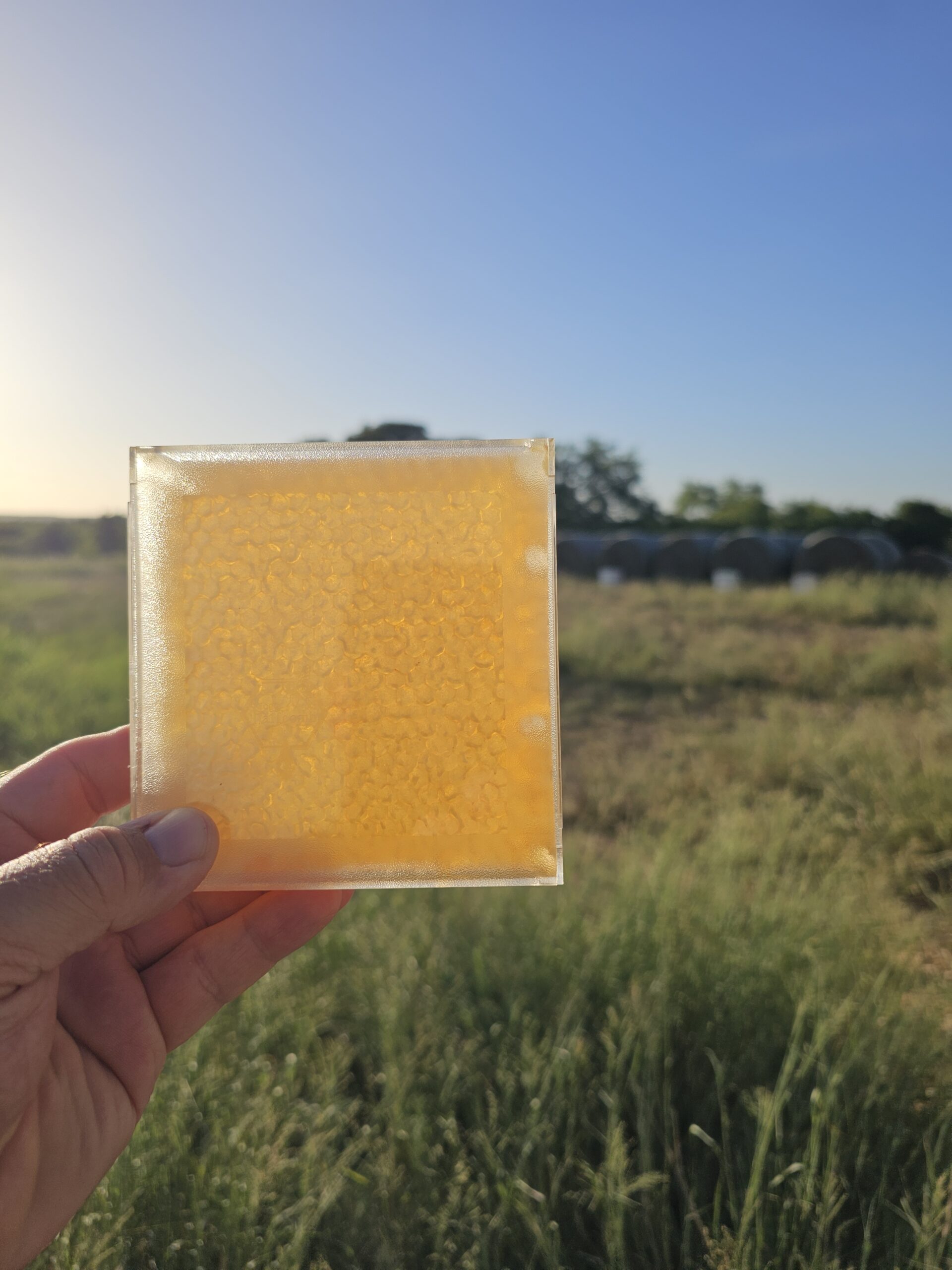

Beekeeping as a Qualified Agricultural Activity

Texas law includes beekeeping as a legitimate agricultural use for the purpose of property tax exemptions. This inclusion is designed to encourage land stewardship and conservation through the support of pollinator populations, which are essential for crop production and ecosystem health, in addition to honey production!

Basic Requirements for Beekeeping Exemption

Minimum Acreage:

Generally, your property must be between 5 and 20 acres to qualify

for the beekeeping exemption.

Number of Hives:

You must maintain a minimum number of bee colonies (usually

between 6 and 12, depending on county regulations) on the qualifying acreage.

Documentation:

Landowners are required to keep records and provide evidence of their beekeeping operation, such as hive maintenance logs, sales records, or honey production

documentation.

Duration:

The property must be used for beekeeping a minimum of 7 months out of each year. Additionally, to qualify for Ag Valuation, the land must have been used for agricultural purposes in at least five of the previous seven years. Obviously, if the property is already exempt, then all you need is to keep bees on the property for 7 months out of each year.

Benefits for Landowners

Reduced Property Taxes:

The primary benefit is a lowered property tax bill, making land ownership more affordable for small businesses and hobbyists.

Support for Local Agriculture:

Beekeepers contribute to local agriculture by providing essential pollination services to farms and gardens in the area.

Environmental Stewardship:

Maintaining bee colonies promotes biodiversity and helps sustain healthy ecosystems.

Why Choose Us as Your Beekeeper?

Entrusting your property’s beekeeping needs to our experienced team means you can enjoy all the advantages of an agricultural exemption without the hassle of managing bees yourself. We provide comprehensive hive management services—from installation and regular maintenance to record-keeping and compliance with all county and state requirements. Our experts handle every aspect of the process, so you can rest easy knowing your land is in good hands and remains eligible for valuable tax benefits.

Whether you’re new to beekeeping or simply want a worry-free solution, our services are tailored to maximize your property’s potential while helping sustain local agriculture and pollinator health. Let us manage your hives efficiently and professionally, so you can focus on what matters most to you—with peace of mind and confidence in your agricultural valuation status.

Pollination Service

If you are needing bees for pollination, fill out our contact form and we will promptly reply.

Contact Form

If you would like to start a beekeeping operation or help in qualifying for the agricultural property tax exemption, please contact us using the form fill below for expert guidance and custom solutions designed for your unique situation.